Cabot builds on a long history in the industrial property business. As this important property sector has evolved, Cabot has transformed its business and become a leading global institutional investment firm with a distinctive focus on logistics properties. The company was formed in 1986 as the investment advisor affiliate of Cabot, Cabot & Forbes, a national real estate company that built some of the first master planned industrial and business parks in the US. Over the ensuing three decades, the industrial property sector has evolved into global asset classes comprised of high-quality functional buildings that are critical to the flow of goods in all major economies. eCommerce and urban migration are driving demand near world-class cities and create significant opportunity for well-capitalized investors.

Events

Events Fund Closings

Fund Closings Office Openings

Office Openings Milestones

Milestones2023

Cabot opens office in Tokyo

Cabot opens office in Tokyo Value Fund VII held a final closing with $1.57B in commitments

Value Fund VII held a final closing with $1.57B in commitments ~85 msf under management at year-end

~85 msf under management at year-end2021

Cabot opens offices in Los Angeles and Amsterdam

Cabot opens offices in Los Angeles and Amsterdam Sale of Value Fund V portfolio for $2.7 billion

Sale of Value Fund V portfolio for $2.7 billion2020

Cabot expands to Australia; opens office in Sydney

Cabot expands to Australia; opens office in Sydney Value Fund VI held a final closing with over $1.1 billion in commitments

Value Fund VI held a final closing with over $1.1 billion in commitments Sale of Core portfolio for $875 million brings historical realizations to $8 billion

Sale of Core portfolio for $875 million brings historical realizations to $8 billion2019

Cabot begins investing in Europe with the first investments closed in the Netherlands and Germany.

Cabot begins investing in Europe with the first investments closed in the Netherlands and Germany. Core Fund II held a final closing with $692 million in commitments.

Core Fund II held a final closing with $692 million in commitments. Firm reaches $10 billion in invested and 187 million square feet (1,427 buildings) owned and managed.

Firm reaches $10 billion in invested and 187 million square feet (1,427 buildings) owned and managed. Cabot embarks on its 50th development project

Cabot embarks on its 50th development project2018

Sale of Value Fund IV portfolio for $1.8 billion

Sale of Value Fund IV portfolio for $1.8 billion2017

Cabot opens its first international office in London.

Cabot opens its first international office in London. Sale of Value Fund II portfolio for $1.1 billion

Sale of Value Fund II portfolio for $1.1 billion2016

Core Fund I held a final closing with over $440 million in commitments.

Core Fund I held a final closing with over $440 million in commitments.2014

Value Fund IV held a final closing with over $700 million in commitments.

Value Fund IV held a final closing with over $700 million in commitments.2013

Sale of Value Fund III portfolio for $1.5 billion

Sale of Value Fund III portfolio for $1.5 billion Cabot reaches 3,000 tenant relationships

Cabot reaches 3,000 tenant relationships2011

First investment closed in the United Kingdom

First investment closed in the United Kingdom Cabot reaches over $5 billion invested and 1,000 buildings managed.

Cabot reaches over $5 billion invested and 1,000 buildings managed.2009

Depth of Great Financial Crisis, Cabot’s funds outperform NCREIF and NAREIT indexes

Depth of Great Financial Crisis, Cabot’s funds outperform NCREIF and NAREIT indexes2008

Value Fund III held a final closing with over 50 investors committing $680 million.

Value Fund III held a final closing with over 50 investors committing $680 million.2007

Cabot reaches 100 million square feet in investments and over 2,000 tenant relationships.

Cabot reaches 100 million square feet in investments and over 2,000 tenant relationships.2005

Sale of Value Fund I portfolio for $695 million

Sale of Value Fund I portfolio for $695 million Value Fund II held a final closing with $450 million in commitments.

Value Fund II held a final closing with $450 million in commitments.2002

Cabot Properties, Inc. was formed as a private equity firm and Value Fund I was launched.

Cabot Properties, Inc. was formed as a private equity firm and Value Fund I was launched.2001

Sale of Cabot REIT in an all cash transaction for $2.1 billion

Sale of Cabot REIT in an all cash transaction for $2.1 billion From IPO to sale, the REIT outperformed the S&P and Dow Jones indices.

From IPO to sale, the REIT outperformed the S&P and Dow Jones indices.1998

Cabot REIT was created via an initial public offering. From 1998 to 2001, the REIT grew total market capitalization to $1.8 billion.

Cabot REIT was created via an initial public offering. From 1998 to 2001, the REIT grew total market capitalization to $1.8 billion.1990

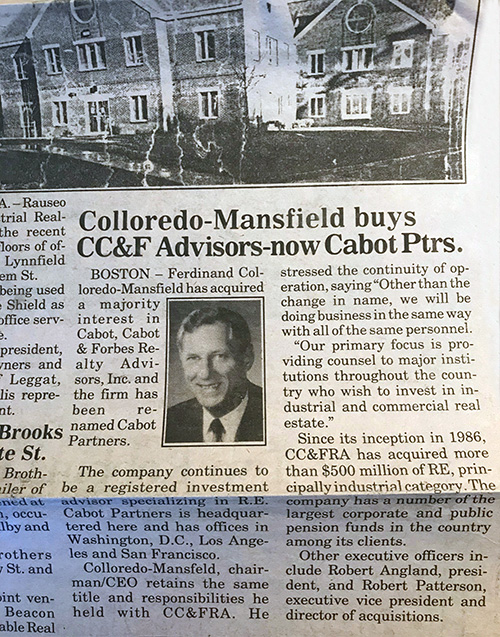

Management orchestrated a buyout to form Cabot Partners Limited Partnership as an independent investment advisor.

Management orchestrated a buyout to form Cabot Partners Limited Partnership as an independent investment advisor.1986

Cabot was formed in 1986 as the investment advisor affiliate of Cabot, Cabot & Forbes, a nationally diversified real estate company.

Cabot was formed in 1986 as the investment advisor affiliate of Cabot, Cabot & Forbes, a nationally diversified real estate company.